closed end credit def

With closed end credit when you originally apply for a loan with the lender the terms never change. In contrast a closed-end credit is when one requests a lender to borrow a specific amount of money.

The borrower must completely satisfy the terms of the loan in that period of time.

. A closed-end credit is defined as credit that must be repaid in full by the end of a fixed term. Most real estate and automobile loans are closed-end. Closed-End Credit Law and Legal Definition.

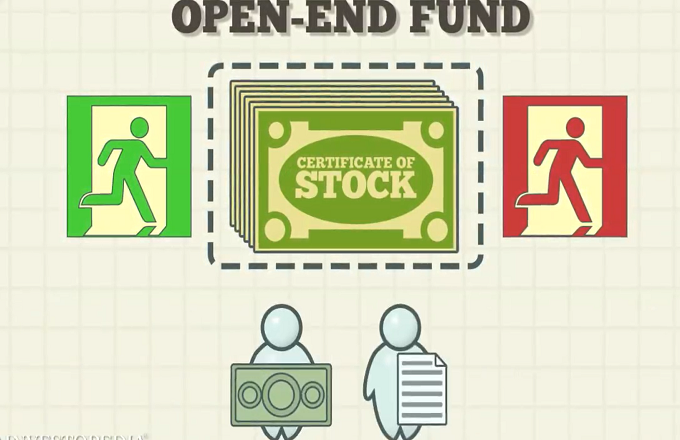

There is often confusion between an open-end credit and a closed one. Open-End Credit With open-end credit you can keep using the same credit over and over as long as you make the minimum monthly payments on time. All three fund types are pooled.

Open-end credit is a contrast to closed-end credit which is more commonly called an installment loan. Mortgage loans and automobile loans are. Closed-end credit is a type of credit that should be repaid in full amount by the end of the term by a specified date.

A closed-end mortgage loan or an open-end line of credit may be used for multiple purposes. Close-end credit An agreement in which advanced credit plus any finance charges are expected to be repaid in full over a definite time. For leveraged funds only forced sales to remain in compliance of leverage limits.

The liquidation of the fund. A closed-end fund legally known as a closed-end investment company is one of three basic types of investment companies The two other types of investment companies are open-end funds. Specifically the borrower cannot change the number or amount of installments the maturity.

A loan agreement in which the lender expects the entirety of the loan including principal interest and other charges to be paid in full by a stated due date. A credit arrangement to be paid in full by a specified date is closed end credit. For example in an.

Closed-End Credit vs. Closed end credit is different because it doesnt allow you to continue using the same credit over and over. This loan must be paid including interest and financial charges within a.

Closed-end funds are investment vehicles that bear a passing resemblance to mutual funds and exchange-traded funds ETFs. You or the dealership in this case receive a. Closed-end loan is a legal term applying to loans that cannot be modified by the borrower.

The repayment includes all the interests and financial charges agreed at the. To better understand open-end credit it helps to know what closed-end credit means. Closed-end credit is used for a specific purpose for a specific amount and for a specific period of time.

Once the closed end credit is paid off and. As mentioned previously a closed-end loan is a highly regulated form of borrowing in which a lender offers a specific sum of money to a borrower that must be repaid. The loan amount interest rate and loan term are agreed upon and both you and the lender must adhere to these terms.

Say you take out an auto loan. Repayment includes the original amount of the loan plus all associated finance charges. A loan agreement in which the lender expects the entirety of the loan including principal interest and other charges to be paid in full by a stated due date.

Closed End Credit is defined 2262 as credit other than open-end credit. Closed-end credit is a loan or extension of credit in which the proceeds are dispersed in full when the loan closes and must be repaid by a specified date. Having a fixed capitalization of shares that are traded on the market at prices determined by supply and demand a closed-end investment company compare open-end.

For example a closed-end mortgage loan that is a home improvement loan under 10032i may. Payments are usually of equal amounts. For example in an automotive loan the lender might extend credit for five years.

Open-end credit is defined as credit extended under a plan in which. Closed end credit is a type of loan which entails a fixed amount of funds sometimes for a specific purpose. In closed-end credit facility credit proceeds must be paid in full on.

A tender offer to repurchase shares which is a method to control discounts. With a closed-end loan you borrow a specific amount of money for a set period of.

/close-up-of-credit-cards-580502979-3998b1e8a9d242c98648cc04ce236e8b.jpg)

Line Of Credit Loc Definition Types And Examples

What Is A Post Credits Scene The Essential Guide To The Movie Stinger With Examples Filmmaking Lifestyle

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

Open Vs Closed End Leases What To Know Credit Karma

What Is A Closed End Fund And Should You Invest In One Nerdwallet

/GettyImages-1139932365-8f9a8413a3f34b2799375e57efeee64c.jpg)

Revolving Credit Vs Line Of Credit What S The Difference

What Are Closed End Funds Forbes Advisor

What Is Open End Credit Experian

/155571944-5bfc2b9646e0fb005144dd3f.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

:max_bytes(150000):strip_icc()/GettyImages-660495523-57c1f9a05f9b5855e57bfa83.jpg)

/GettyImages-923217650-70de1e010cdd4448b137a93421018b33.jpg)